- Chalk Chain

- Posts

- 📰 We're Back?

📰 We're Back?

PLUS: 5K Subs & Shoshin is shorting ETH.. 🐻

GM Legends! The market has bottomed, macro sentiment is slowly rising, and even my AI bags are almost break-even! Welcome back to Chalk Chain Weekly📃

This Week:

📝 Market Update

👑 WIC: 5K Subs & Bullish Vibes

🈳 Shoshin: BTC Update, ETH Short

📊 Market Overview: The Business Cycle and Fear & Greed Index

Markets are still stuck in an awkward limbo. Economic data is feeling the squeeze from ongoing trade war tensions, but investor sentiment is cautiously stabilising, with fear cooling off back to neutral.

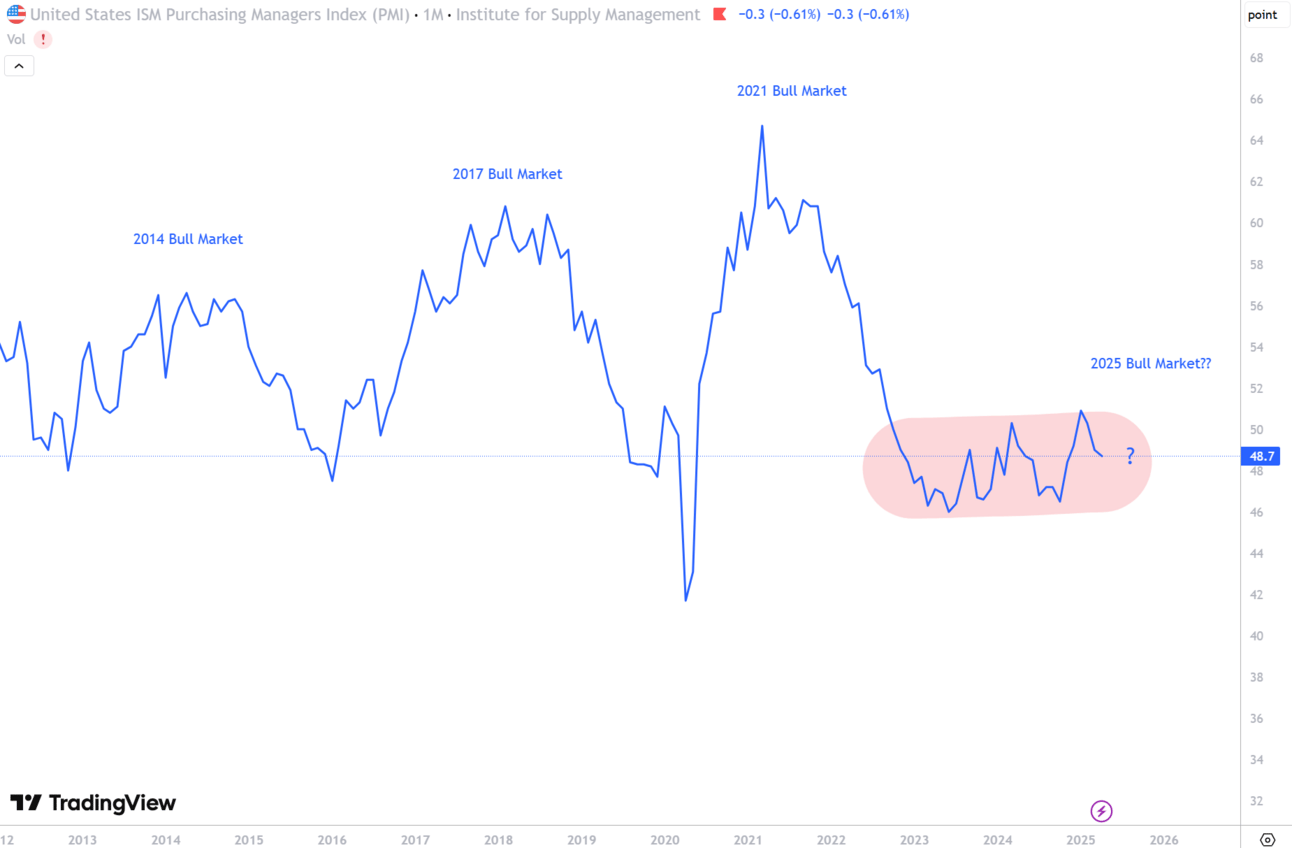

So let’s evaluate with one of my favourite macro indicators: The ISM.

The ISM is a business cycle indicator often called the heartbeat of the economy: expansion, peak, contraction, and recovery. It influences everything from investor confidence to risk appetite. In crypto, it often defines whether we’re in a Bitcoin-led market or a broader altcoin bull run. When macro conditions ease and growth picks up, liquidity flows into riskier assets, including crypto. You can clearly see the historical association with each bull market run:

TradingView

Right now, the ISM has been stuck in sideways chop for almost 30 months, mostly due to extremely tight global financial conditions.

But that’s starting to change with dropping oil prices and the USD. Historically, that combo ticks the box for a crypto bull run ✅

However, the wildcard remains: the ongoing US-China trade war. It’s been a massive drag on growth, holding back the ISM from launching an epic bull market. Until there’s a clear resolution, ideally through major tariff deals, markets will likely remain choppy.

Let me be clear, we’ve seen a great rally of the ISM, but I expect the ISM to dip again in the short term before recovering when major trade deals are announced, as we’ve seen with the recent US/UK trade agreement.

📉 Fear & Greed Index: What It’s Telling Us

Right now, the Crypto Fear & Greed Index is sitting at 71—a bullish reading. Historically, this index has served as a solid contrarian signal. Extreme fear (in the red zone) often marks good buying opportunities, while extreme greed (in the green zone) can signal local tops.

The swings into the fear zone during March and April—sparked by tariff panic—turned out to be good entry points. Looking ahead, we may see this chart hit the green zone multiple times over the next year as conditions improve.

A reading of 71 doesn’t offer a strong signal one way or the other. But here’s the key takeaway:

Buy in fear, sell in greed remains a tried-and-true principle.

Allocating during neutral sentiment can still be a smart move, especially for long-term investors, as long as the business cycle hasn’t topped (and I believe it hasn’t).

The next move hinges on news—good news could fuel a rebound (e.g. US/UK deal), but more bad data and we’re likely headed lower.

❓ So, when altcoin season?

Short-term alt pumps might be exciting, but Bitcoin continues to be the best risk/reward play until the macro picture improves.

I’ve sold some of the highest-risk AI/meme plays for small profits and will look to reallocate if/when we retrace.

On-chain signals, like the Dune Index, suggest we may have bottomed, but the trend isn’t confirmed. Eyes on Bitcoin price movement, it’ll lead the rest.

What is Crypto (Matt)

🐂 5K Subs, Bullish Vibes & a Crypto Comeback

Matt just blasted through 5,000 YouTube subscribers and didn’t even notice. That’s what happens when you’re locked in on the charts, and crypto is waking up again. With over 500 new subs in just one week, people are paying attention, and not just to the markets; they are loving Matt’s insights and signature energy.

Here’s what Matt’s seeing right now:

The market is cooking, and he’s sitting comfortably in spot positions.

He’s eyeing pullbacks as buying opportunities, not warning signs, especially with some ETH dry powder ready to deploy.

A full retrace? Unlikely in his view. A correction, maybe, but probably not more than 50%.

Matt’s watching ETH, Bitcoin Dominance (BTCD), ETH/BTC, and Total2/Total3. These are the key indicators in this stage of the cycle.

And yes, FBB4 is back on the loose, throwing cash around like it’s a bonfire, and he's fully leaning into this rally.

Matt is in the works to team up with Shoshin for a video balancing Matt’s bull optimism with some cool-headed analysis.

That said, the message is clear: while everything is "cooking stupidly hard" and some 10x plays are flashing across the screen, risk management is key. If you're in a quick narrative trade, secure those profits.

To quote Matt:

“We’re going to run it up so hard over the next 2–6 months.”

Stay tuned. Stay sharp. The bulls are back.

📺 Market Summary and Top 10 Memecoins to Buy now

Markets are pumping!! What do I buy? Don’t just buy, understand WHY 👇

For real-time alpha and trade alerts from Matt at What Is Crypto

📲 Follow on X: WhatIsCrypto

🔔 YouTube: WhatIsCrypto

🗨️ Join our Discord Community

Shoshin

🪙Bitcoin Update

Shoshin has again executed his disciplined strategy of larger swings and a focused dedication to the majors, especially BTC.

“I've fully embraced trading larger swings and sticking to the majors—primarily BTC”

TradingView

It’s a refreshing reminder that trading doesn’t need to consume every waking hour. With a leaner, high-conviction strategy, Shoshin is choosing efficiency over constant engagement.

Well-Timed Patience: BTC Long Up 31.5%

Backing that strategy is a sharp entry and steady hands. Shoshin entered their BTC long at $78,000, and the position is now up 31.5%. Rather than over-managing the trade, he's trimmed exposure and currently sits at 50% BTC exposure, locking in gains while staying exposed to potential upside.

Smart Hedging: ETH Short in Play

To balance current market exposure, Shoshin has also opened an ETH short, effectively hedging his broader portfolio. The short position makes up 25% of the portfolio, which is half the size of the BTC long.

With this hedge in place, his net long exposure is 25%, factoring in both the BTC long and ETH short.

His ETH short was driven by a combination of technical and situational signals:

A sharp weekend pump

Price testing major resistance

A thin, inefficient move upwards

A 40% move in just 3 days

And importantly, BTC approaching resistance

As I have mentioned before, Bitcoin remains one of the strongest assets globally, despite macro pressures and trade wars.

If you are looking for a good entry, follow Shoshin closely; there will be more opportunities.

Stay Up-to-Date with Shoshin

📲 Follow on X: ShoshinTrading_

🔔 YouTube: ShoshinTrading

🗨️ Join our Discord Community

As always. Zoom out. Take a breath. Touch grass. 🌱

If you want more market analysis and for the most up-to-date alpha

Join the community Discord

Also, if you aren’t already, subscribe to the Newsletter, X and Youtube so you don't miss out.

MEMES OF THE WEEK

@boldleonidas

@naiivememe

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.