- Chalk Chain

- Posts

- Pro Report |🐮 CoW Swap: A Beginner’s Guide

Pro Report |🐮 CoW Swap: A Beginner’s Guide

Uniswap, but... better?

The crypto world loves to personify its tokens, and CoW Swap is no different. However, CoW Swap is much more- it has forever changed how users swap tokens.

Discover what sets CoW Swap apart in this beginner-friendly guide.

In This Report:

(5 minute read)

1. What is CoW Swap?

CoW Swap is an innovative decentralized exchange (DEX) designed to help traders secure the best prices by scanning various platforms and DEX aggregators. 🔍

It addresses challenges like MEV, slippage, and high gas fees that other DEX’s suffer from.

Cow Swap is the front end for the CoW Protocol, the underlying technology that powers it. It was developed referencing the Uniswap interface.

2. How it Works

At its core, CoW Swap is built on the principle of the “Coincidence of Wants” (CoW), enabling two traders to directly exchange assets without relying solely on external liquidity pools. This approach not only optimizes order execution but also embodies crypto’s ethos of decentralization and efficiency.

What is the “Coincidence of Wants”? Throughout history, money has served as a medium for exchanging goods and services. However, in rare cases, two parties might hold exactly what the other desires, allowing them to trade directly without involving money.

CoW Swap Exchange Model

This phenomenon, known as the "Coincidence of Wants," is uncommon in physical markets due to the difficulty of finding perfect matches. For example, it’s highly unlikely to find someone who wants to trade a small house for a specific car in a particular area.

In financial markets, particularly with digital assets, this concept becomes far more practical. Investors can directly exchange tokens or stocks, making the CoW principle especially relevant in decentralized finance (DeFi).

Woah… confused already?🤔

Let me explain like I’m 5 (ELI5) 🖍️

Alright, imagine you have a red crayon, but you really want a blue crayon. You don’t want to go to the crayon shop because it’s far away and costs a lot.

Now, your friend also has a blue crayon but really wants a red one. Instead of going to the shop, you both trade crayons directly—simple and quick! This is what CoW Swap does, but with tokens.

If it can’t find a friend to trade with you right away, CoW Swap looks around at all the “crayon shops” nearby to get you the best deal without you doing any extra work. It’s like having a super-smart helper who knows where to find the best crayons for you.

3. Why it’s Better

CoW Protocol has several advantages over traditional trading protocols, including:

Better Prices: By accessing a broader range of liquidity sources and capitalizing on direct peer-to-peer matches, CoW Protocol often secures more competitive prices for traders than standard AMMs or DEX aggregators.

Lower Gas Fees: Batch auctions enable multiple orders to be settled within a single transaction, significantly reducing gas costs for users.

Enhanced MEV Protection: CoW Protocol employs a specialized mechanism to shield traders from Miner Extractable Value (MEV) exploitation, such as front-running or sandwich attacks, ensuring fairer and more secure transactions.

No middlemen: CoWSwap protocol eliminates third parties from the exchange process that would otherwise charge additional trading fees.

No gas expenses on failed transactions: Traders only have to pay network fees in case their orders were successful.

4. CoW Swap vs Uniswap

The CoW Swap interface may feel familiar to seasoned DeFi users since it builds on the open-source code of UniSwap. However, several unique features set it apart:

New vs Old

Multiple Liquidity Sources: Unlike UniSwap, which relies solely on its own liquidity pools backed by market makers, CoW Swap connects to a variety of platforms like SushiSwap, 1inch, and others. This broad access helps users secure the best possible price.

Direct Asset Exchange: CoW Swap enables users to trade assets directly without routing transactions through liquidity pools, offering a more efficient and streamlined experience.

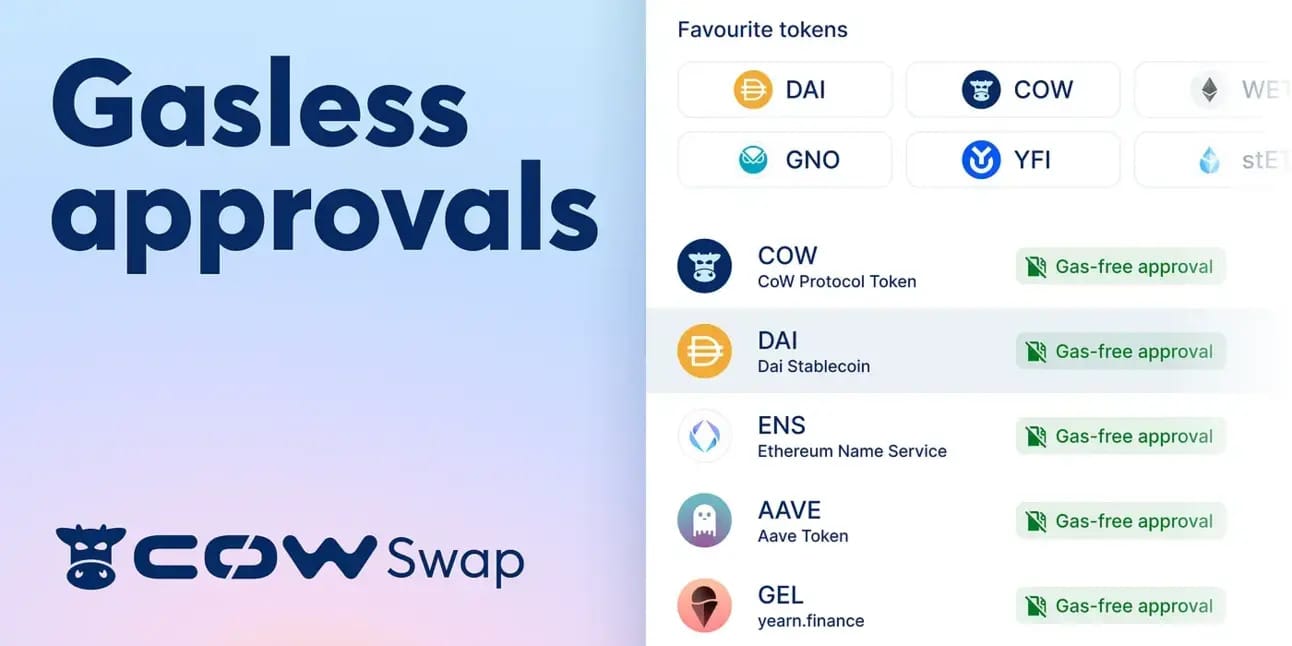

Gasless Orders: Trades on CoW Swap are executed as signed messages, eliminating the need for upfront gas payments. Additionally, users don’t incur network fees for failed transactions, a common issue with UniSwap.

These features make CoW Swap a standout solution, addressing key challenges faced by UniSwap and similar platforms while offering a superior user experience.

5. $COW: Should I Buy?

If you’re a fan of CoW Swap’s ecosystem, let’s dive into the investment potential of $COW.

Here’s a quick summary of how $COW’s revenue streams: 💰

CoW Swap: Earnings are used to buy back $COW tokens every week, creating consistent buying pressure

MEV Blocker: Generates revenue in $ETH, increasing the DAO’s treasury.

CoW-AMM: Hasn’t generated revenue yet but holds significant potential as it scales.

Token Valuation By combining these revenue streams, CoW Protocol could achieve over $130 million in annual revenue. This means the $COW token’s value could reach $6 in the base case.🚀

$COW at $0.88 - Dec 16. Source: TradingView

Potential Growth Scenarios 📊

Even at its current price of $0.88, this represents a significant upside:

Bear Case: 2x growth in 12–18 months ($1.6).

Base Case: Around 20x potential ($6).

Bull Case: A staggering 88x opportunity ($28).

Final Thoughts

If you haven’t tried CoW Swap or its products, now’s a great time to join the Cowmmunity. Even if you’re not an investor, using their tools could save or earn you money.

For investors, $COW presents a unique opportunity in a growing market segment.

Good luck, and happy trading! 📈

Enjoyed this Pro Report?

Stay informed, stay entertained, and stay ahead. Subscribe to Chalk Chain Weekly and never miss out!

FAQs

Who are CoW Swaps Competitors?

CoW Swap competes with platforms like UniSwap, Balancer, Bancor, and 1inch. However, it distinguishes itself through its unique order book mechanism, setting itself apart.

Is CoW Swap Safe?

CoW Swap has undergone an audit by Hacken and leverages Safe by Gnosis for wallet management. Additionally, it uses an RPC designed to mitigate MEV attacks. While no protocol can guarantee absolute security, CoW Swap incorporates multiple safeguards to protect its users.

How is CoW Swap Different from Uniswap?

UniSwap uses an automated market maker (AMM), while CoW Swap operates with a ledger order book (LOB). Moreover, UniSwap functions as a decentralized exchange (DEX), whereas CoW Swap acts as an aggregator.

What is a Dex Aggregator?

A DEX aggregator streamlines trading by routing users' orders through the most efficient paths. It compares prices across multiple decentralized exchanges and selects the best one to execute the trade, ensuring better prices for the user.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.