- Chalk Chain

- Posts

- 📰 A Birds Eye View🐦

📰 A Birds Eye View🐦

PLUS: Market Updates, Trades and Touching Grass 🌱

GM gm Legends! Welcome back to Chalk Chain Weekly—the newsletter that’s the tariff to your trade war 💰

This Weeks Tariffs:

🐦 A Birds Eye View

👑 What Is Crypto: Advice, Market Manipulation, Trades

🈳 Shoshin: Increase your win rate by 614%, Market Update, Portfolio Tracker,

📝 Chalk Chain: Ethereum Rally, Touch Grass

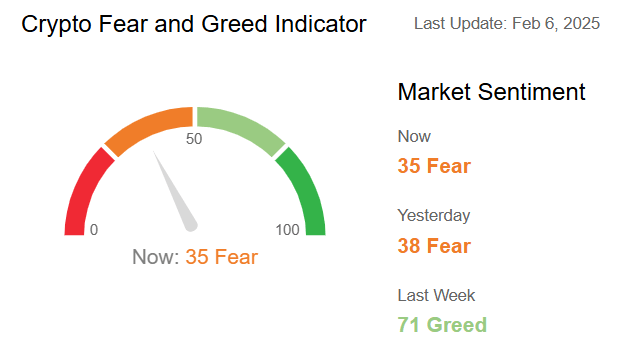

We’ve hit a pivotal transition from Greed > Fear

🐦 A Birds Eye View

🔍 When in Doubt, Zoom Out

The past two weeks have been full of market turmoil and uncertainty.

Let’s break down the good, the bad, and the ugly… while taking a step back for a broader perspective.

🚀 Bullish News

Since Trump took office, the crypto market has been flooded with positive developments:

🧑💼 SEC Crypto Task Force – The SEC is forming a dedicated team to regulate the US crypto industry, bringing long-awaited clarity.

📈 Franklin Templeton's ETF – Investment giant Franklin Templeton has applied for regulatory approval to launch a new crypto ETF.

🏦 Banks Can Hold Crypto – The SEC has approved banks to custody digital assets.

⛓️ Tornado Cash Sanctions Lifted – A US judge overturned sanctions against the controversial crypto mixer.

A year ago, this would have been unthinkable. Yet, prices haven’t skyrocketed—why? Because markets had already priced in this bullish momentum post-election.

🛑 Bearish Headwinds

Despite the optimism, recent events have spooked investors:

📦 Tariff Threats – Trump proposed a 25% import tariff on goods from Canada, Mexico, and China.

🤖 DeepSeek Disruption – In last week's newsletter, we covered Deepseek, the Chinese AI model that has drastically lowered the cost of AI training and inference.

Uncertainty reigns, and markets hate uncertainty.

🔭 The Bigger Picture

Even with short-term volatility, BTC just closed a monthly candle above $100K—a major milestone.

The macroeconomic backdrop remains steady:

The Federal Reserve paused rate cuts, keeping rates about 1.5% above inflation.

BTC’s price barely reacted.

💥 DeepSeek & BTC’s Sudden Drop

On January 26, news of DeepSeek R1—a Chinese AI model rivaling OpenAI at a fraction of the cost—sent shockwaves through markets:

BTC fell 7% from $105K to below $98K.

Nvidia stock took a hit as investors realized fewer AI chips might be needed.

What’s notable? BTC didn’t drop immediately. It fell only when US futures markets opened—suggesting institutional investors sold off both tech stocks and BTC in reaction.

But retail bitcoiners weren’t fazed. They bought the dip, and BTC quickly rebounded—while Nvidia is still struggling.

📌 Key Takeaway

Short-term turbulence aside, the long-term trend remains strong.

Zoom out, stay focused, and let’s see where the market heads next. 🚀

🌟Member Shoutout

Big shoutout to NDP for his meme contribution this week! 👏

His contributions have made a real difference, providing laughs and inspiring the discord community. Grateful to have you here! 🎉

What is Crypto (Matt)

💪 Staying Strong in the Crypto Game

Let’s be real—most of us are down bad right now. It sucks. No sugarcoating it.

Did I see the market bleeding this much? Nope. But here’s the thing: we’re not selling. At least, I’m not.

So if selling isn’t an option, what do we do? We build.

📝 The Game Plan

Network – Connect with like-minded people, share ideas, and stay in the loop.

Build – Whether it’s skills, projects, or knowledge, now is the time to invest in yourself.

Accumulate – If you believe in the long-term, keep stacking.

Move forward – No looking back. We’re here for the long haul.

I might be wrong about timing, but if I am, it’s by months—not years. There’s no way I’m walking away without making it in crypto. I’ve worked too damn hard, sacrificed too much time, and quitting is not an option.

🏆 How You Can Win Too

If you want to succeed, the best thing you can do is:

✔️ Help me grow the channel – The bigger our community, the stronger we are.

✔️ Accumulate smartly – Focus on the projects we can actually impact.

✔️ Watch DXY – when it takes off, we’ll PRINT HARD.

Yes, this market sucks right now. But we’re not quitting. So we suck it up and keep pushing forward. 💪

💡 One Last Reminder

Feeling deflated? You’re not alone. Just remember one thing: TAKE PROFITS when the time comes.

Oh, and FYI—I’m DCA’ing here. Every fortnight when I get paid, I’m stacking.

Stay focused. Stay patient. Our time will come. ⏳

For a deep dive into the market crash, here’s Matt to explain what happened and what you should do. 👇

This week’s trades:

🚨Buy Alerts

$DXY - DCA into highest conviction meme play

$DSYNC

$PEPECOIN - Took a fairly Large Pepecoin Spot Position - BasedAI integration, Pepecoin deflationary burns and FBB4's largest backing - I think this cooks

PEPECOIN @ Trading View

⚠️Sell Alerts

$DSYNC - Closed the Dsync I brought yesterday here. I’m up 40% on a day. I still have a very large other bag of Dsync and think it’s a great play. I’m only closing this as I want to build up my stables so if something like this happens again I can capitalise fully.

For real-time alpha and trade alerts from Matt at What Is Crypto

📲 Follow on X: WhatIsCrypto

🔔 YouTube: WhatIsCrypto

🗨️ Join our Discord Community

Shoshin (TradingWright)

📈 How I Could Have Increased My Win Rate by 614%

After reviewing my trades from the past month, one key factor became glaringly obvious. While I had some small profits, a few break evens, and minor losses, I realized that by adjusting one approach, I could have:

✅ Taken 82% fewer trades

✅ Increased my win rate by 614%

🔑 The Key Factor: BTC Support Matters

The mistake? Trading alts without considering Bitcoin’s position.

Even if an altcoin is at strong support, it’s a low-probability trade if BTC isn’t also at support.

Several of my trades looked great technically, yet still broke down when BTC dipped just a few percent.

If BTC is at resistance, the chances of a failed alt trade are much higher.

The same rule applies to taking profits:

If BTC is at resistance, it’s a signal to take profit.

If BTC is at major resistance, scaling out or closing the trade entirely is often the best move.

⚖️ Quality Over Quantity

Placing a trade isn’t the end of the job—it’s just the beginning. Markets move fast, and conditions change quickly.

Fewer, high-quality trades lead to better results.

Less stress, less admin, better outcomes.

Trading is a game of probabilities—and the best traders stack the odds in their favor.

📊 Market Update & Strategy: How I’m Trading Now

The market is in a tough spot right now. The relationship between altcoins and BTC is shifting compared to past cycles, creating a unique dynamic. While there are several factors at play, that’s a discussion for another time.

What’s clear is this: BTC has never been more dominant. Its influence keeps expanding, and its strength continues to grow.

🪙 Bitcoin Outlook

BTC is leading the market, setting the tone for overall trends.

Currently mid-range, making it a higher-risk position.

If BTC drops, the entire market will take a hit.

The weekly Ichimoku shows an unbalanced structure, with highs being taken out and rejected.

Probability suggests a 50/50 directional split, though there’s a slight bias toward a downside correction.

Current BTC Scenarios

📌 Plan: Wait for BTC to reach an optimal risk/reward (R/R) zone before going in heavy. That means:

✔️ Taking out range lows around $90K again.

✔️ Ideally dipping into the $80K region for strong bids.

💰 Altcoin Strategy

Not the time to go heavy into alts.

Key majors (ETH & SOL) will signal overall altcoin strength.

High-cap alts on watchlist: $DOGE, $LINK, $HYPE.

Market selection is critical—be highly selective with alts.

The best approach:

✔️ Bid BTC at lower levels or

✔️ Enter strong alts at major weekly S/R zones (aligned with BTC moves).Buying at key S/R levels on alts can provide short-term outperformance against BTC.

🎯 Execution Plan

Given BTC’s:

Mid-range positioning

Dominance over the market

Need for lower levels to reach ideal R/R

I’ll be placing bids at key S/R levels on select alts.

In Practice, it looks like this:

1️⃣ Sell into the initial bounce

2️⃣ Let the rest ride

3️⃣ Cycle profits back into BTC to maintain balance

This outlook may shift as the market evolves, but for now, this is the best approach for me as a trader.

This week’s trades:

🚨Buy Alerts

$YNE - AI Agent narrative with low cap and big potential. The team is cooking something big + chart looks great.

YNE so far

$ETH - Picked up more ETH yesterday to lower average, then closed 50% earlier today and the rest just now on this bounce into resistance.

ETH 1 Week @ TradingView

$LTC - Bought more LTC yesterday, then closed everything on this bounce.

⚠️Sell Alerts

$AI16Z - Closed AI16Z yesterday and rotated into YNE

$AVAAI - Closed AVAAI yesterday and rotated into YNE

Stay Up-to-Date with Shoshin

📲 Follow on X: ShoshinTrading_

🔔 YouTube: ShoshinTrading

🗨️ Join our Discord Community

Chalk Chain (Lachy)

🚀 Ethereum Gearing Up for a Breakout

A Test of Patience

Ethereum, once the darling of the last bull run, is still struggling to break out. After failing to push past a key resistance in its triangle pattern, it’s back within its range. Sentiment remains weak, even reaching the Ethereum Foundation, where some community members are calling for faster development timelines and leadership changes.

🧐 Who’s Buying?

Despite this uncertainty, ETH is still being heavily accumulated. Most notably, World Liberty Financial—the Trump family’s DeFi project—has been buying Ether.

The Trump family’s DeFi project, World Liberty Financial, currently holds $210M+ in Ethereum—nearly 4x their Bitcoin holdings.

That’s a clear signal that they’re heavily invested in ETH’s future.

Let’s repeat that: The U.S. President is accumulating ETH, and yet, it still hasn’t hit a new all-time high.

If That Wasn’t Enough… Eric Trump Says It’s a Great Time to Buy Ethereum

Yes, you read that right. The son of the President of the United States just called Ethereum a great buy.

In case you’re unfamiliar with the Trump family tree, Eric Trump is Donald Trump’s third child.

Yesterday, he posted a tweet suggesting now is a great time to buy ETH.

He even edited the tweet twice before settling on the final version.

His original message? “You can thank me later.” 👀

@erictrump

🔍 The Technical Outlook

From a purely technical perspective, ETH’s long-term structure still looks bullish:

Price is squeezed into a large triangle formation.

Potential inverse head-and-shoulders pattern emerging—historically bullish.

Breaking above ~$4,150 could signal a strong move toward $8K.

ETH/USD @ TradingView

So, after two months of sideways action, some investors are getting restless. Trump is in office—so where’s the new all-time high?🤨

Relax. Markets don’t pump nonstop. Consolidation is healthy and necessary before the next leg up.

Take a breath. Touch grass. 🌱

If you want more market analysis and for the most up-to-date alpha

Join the community Discord

Also, if you aren’t already, subscribe to the Newsletter, X and Youtube so you don't miss out.

MEMES OF THE WEEK 😂

It’s back!

@naiivememe

@boldleonidas

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.